Perth Property Market Review

Is Perth going to be countercyclical to east coast capital cities?

So, what’s happened in the last 12 months? Melbourne and Sydney property prices are coming off their highs. However, it must be remembered these cities had big increases in values over the past few years.

If east coast capital cities come off further, what will that mean for Perth, where growth has been stagnant for some years? And will we see some countercyclical growth in the local property market?

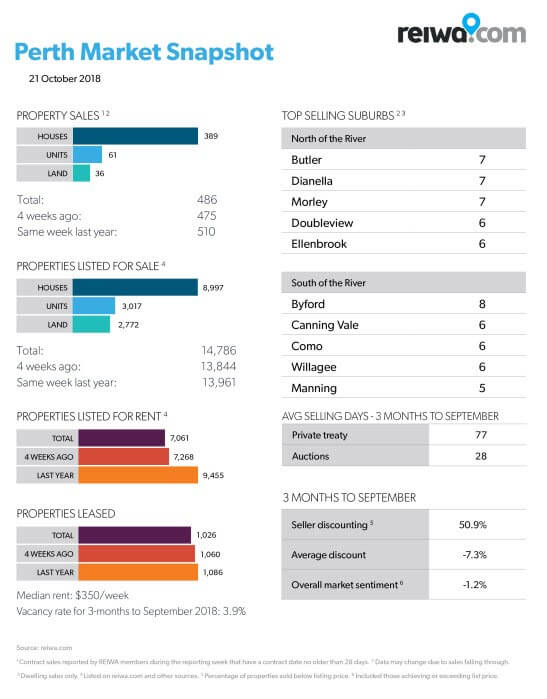

Before we answer these questions, let’s see the REIWA October Perth Property Market Snapshot.

Disappointingly, listings are higher than 12 months ago, which is likely a symptom of Perth’s stagnant population growth. That said, the rental market is traditionally a leading indicator of property growth, so how can a strong rental market drive property values? Here are the basics of how it traditionally works.

As properties available for rent decrease, weekly rents are forced up. As these weekly rentals approach the amount of a mortgage repayment, renters often decide to buy, creating demand for first home owner suburbs. This flows through to upgrader suburbs and so begins the property growth cycle.

The Perth Property Market Snapshot for October shows a 3.9% rental vacancy rate. At the same time last year, this was nearly 7%.

If Perth can get some population growth, the signs are very positive for the Perth real estate market.

If you are looking to do something - anything - please give us a ring on 08 9381 8311.

We are happy to listen to your future plans and assist you in determining how much you can borrow or simply be a sounding board for your ideas. Whilst we cannot predict which way the market will go from here, we can assist with advice so you know what you can and can't do. We can even assist you in obtaining a finance pre-approval so that you can step forward with confidence, understanding your options for any intended purchase.

Let us do the heavy lifting to qualify you for finance for your next real estate purchase.